Long Term Care Options (LTC)

AGIS Network specializes in finding LTC options that fit your needs.

GET IN TOUCH

Help Protect Your Family,

Future and Finances

At any point in your life, you may need LTC services, which could cost hundreds of dollars per day.One solution doesn't work for everyone. So, understanding the different types of Long Term Care insurance is essential for successful financing of Long Term Care needs.

How We Can Help

AGIS Network’s LTC specialists are here for you. Rely on our experienced team to learn what options fit your needs with no obligation. AGIS represents multiple top-rated insurance carriers, and we provide options so you can select the plan best suited for you or your spouse/partner.

Personalize an action plan to safeguard your family, finances, and future!

- Health and disability insurance do NOT cover LTC expenses.

- Often people wipe out their retirement savings and other assets to fund in-home care.

- Avoid relying on family, friends or neighbors for daily help and assistance which may not be adequate, convenient, or even possible.

- States are starting to propose, and some may potentially enact, legislation that creates new taxes for individuals if they do not own private LTC insurance.

- The sooner you apply, the better! Premiums are based on your age at application. Typically, the younger you are, the healthier you are, which makes it easier to be approved for coverage.

What is Long Term Care (LTC) Insurance?

We all might need a little extra help some day as the result of an accident, illness, or age. LTC insurance is designed to pay the cost of extended professional caregiving. Most LTC is non-medical; it includes assistance with activities such as taking a bath or moving from a bed to a chair, or caring for someone with severe cognitive impairment.

The Basics of Long Term Care Insurance

What is Permanent Life

Insurance With LTC?

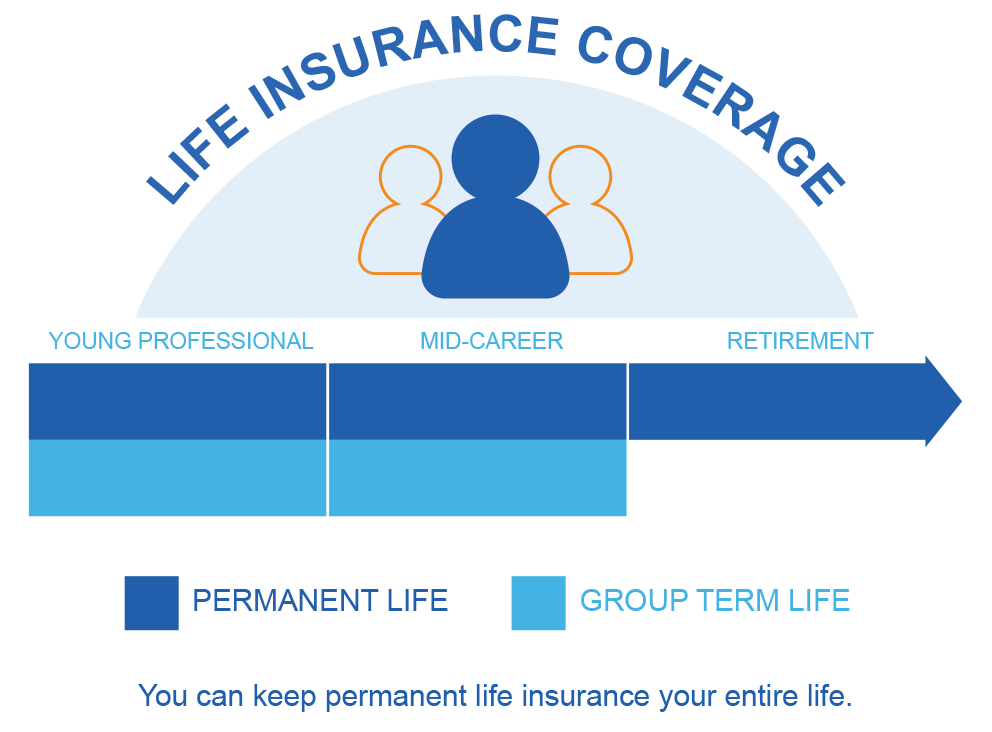

Many of us have group term life from our employer and potentially some “supplementary” group term life insurance. Those policies protect us for an “unexpected death” during our working careers. Permanent Life insurance is life insurance we take into retirement at the same cost as when we were working, but it is for our “expected death” late in our golden years.

Too many employees have no life insurance when they retire, this program solves that problem. We might not need as much life insurance as when we were working, but it is likely we want/need more than zero. And this policy will pay LTC benefits should those be needed and still maintain a death benefit that pays out later whether we use the LTC benefits or not.

Life w/LTC Insurance

What is Short Term Care (STC) Insurance?

Like Long Term Care insurance, Short Term Care insurance plans help with home care, assisted living, and nursing homes, and usually offer benefits for up to a year.

The Basics of Short Term Care (STC) Insurance

Media

For full screen double click on the video.